Hey sisters! Are you still worrying about losing money in the stock market? Are you still struggling with when to buy and when to sell? Today, I’m going to share with you the trading secrets of the legendary Wall Street figure, Jesse Livermore, especially the practical part after he identified the key points. I guarantee you’ll be amazed after reading this: “Wow! It’s that simple!”

I used to be a stock market newbie. I got dizzy just looking at the K-line chart, let alone finding the entry and exit points. Later, I started studying Livermore’s trading rules and found his methods to be super practical! Especially his buying and selling strategies after the key points, it’s simply “foolproof” operation, allowing newbies like me to get started easily.

🌟What exactly is Livermore’s “Key Point”?

Simply put, a key point is a turning point in the price movement of a stock. It can be:

- Breakout above resistance: The stock price rockets through the previous high, often indicating the start of an uptrend.

- Breakdown below support: The stock price plummets below the previous low, often indicating the start of a downtrend.

- Increased volume: Whether it’s rising or falling, if the trading volume suddenly increases, it means something big is about to happen. It could be the beginning of a trend or the end of a trend.

🚀After identifying the key point, how to buy like Livermore?

Livermore is not the kind of person who goes all-in as soon as he sees a key point! He is super cautious and has his own buying strategy:

- Enter with a pilot purchase: After the key point appears, test the waters with a small amount of capital to see if the market is really moving as you expect.

- For example, if you think a stock is about to break through a resistance level, buy 100 shares to test the waters.

- Add to your position gradually: If the market moves as you expected, then gradually add to your position.

- After breaking through the resistance level, the stock price continues to rise, you add another 200 shares.

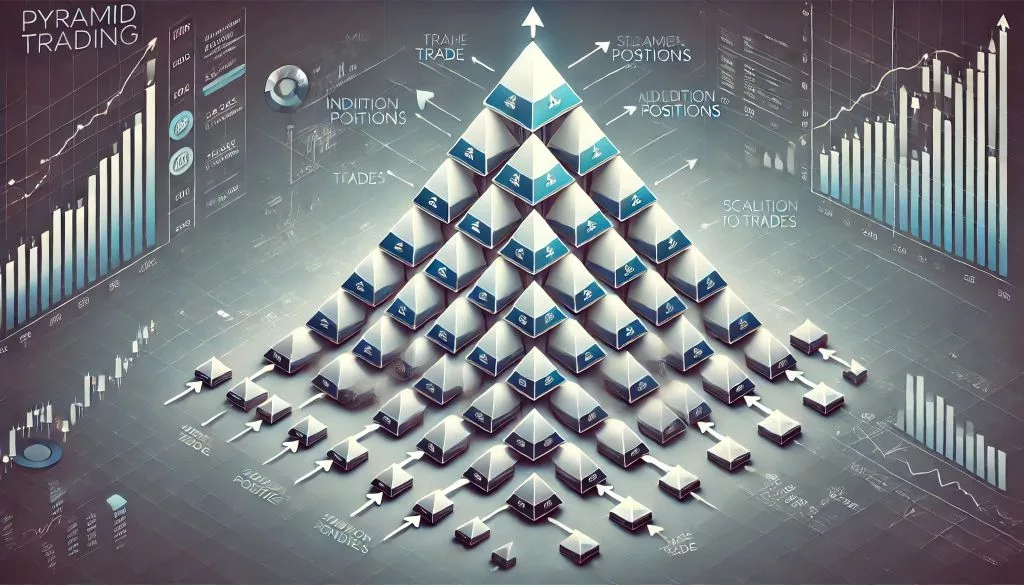

- Pyramid your purchases: The further you add, the smaller the quantity should be, which can reduce risk.

- The stock price continues to rise, you add another 100 shares, forming a “pyramid” shape.

- Set a stop-loss point: This is super important! When you buy, you need to think about how much loss you can bear if the market moves against you.

- For example, you set a stop-loss point at 5% of the purchase price. If the stock price falls below this level, sell immediately, don’t hesitate!

💥After identifying the key point, how to sell like Livermore?

Selling stocks is more difficult than buying stocks! Because we are always greedy and hope that the stock will rise higher. But Livermore tells us to learn to take profits in time:

- Reach the target price: Before you buy, you need to think about how much money you want to make from this stock.

- For example, if you think a stock can rise by 20%, then set a target price and sell immediately when it reaches it.

- Reversal signals appear: If you see the stock price starting to fall, or the trading volume suddenly increases, this may be a signal of a trend reversal, and you should sell quickly.

- For example, the stock price falls below the previous support level, or a “dark cloud cover” candlestick pattern appears, these are all sell signals.

- Reduce your position gradually: Like buying, selling should also be done gradually, not all at once.

- For example, you sell one-third of your stocks first. If the stock price continues to fall, sell another one-third, and finally sell all of them.

- Don’t chase the rise and kill the fall: This is a mistake that many newbies make! They chase the stock when they see it rising, and sell it quickly when they see it falling. This is very likely to lead to losses.

💡My practical experience sharing:

I have used Livermore’s method several times, and it feels really great! Once I saw a stock break through the resistance level, and the trading volume also increased, I followed his method to gradually buy, and finally made about 30%!

Of course, I’m not always successful. Once I saw a stock fall below the support level, thinking it was going to start falling, I sold it quickly, but it rose back the next day, which made me so mad!

So, Livermore’s method is not 100% accurate, we still need to combine our own actual situation, continue to learn, and constantly summarize experience.